Bitcoin (BTC) continues to decline on Monday, February 2, trading below the $77,000 level due to a combination of macroeconomic headwinds, institutional outflows, and forced liquidations.

Despite ongoing volatility, investors are already looking ahead to where Bitcoin could settle by the end of February, with artificial intelligence (AI) models offering early insight into potential price trajectories amid elevated uncertainty.

Bitcoin AI price prediction

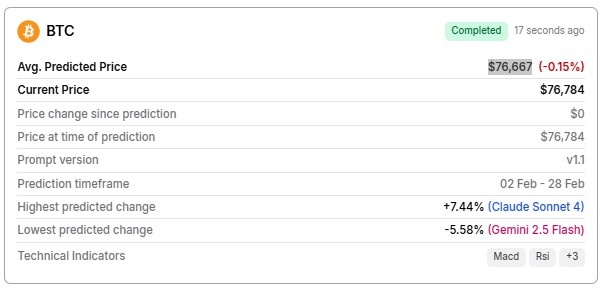

Finbold’s AI-driven price prediction tool, which aggregates forecasts from ChatGPT, Gemini 2.5 Flash, and Claude Sonnet 4 to generate a more diverse range of potential Bitcoin price targets, predicts a BTC price of $76,667 for February 28, 2026.

The figure represents a modest change from the current price of $76,784, suggesting the flagship crypto is going to lose another 0.14% by the end of the month, which would drag it down to levels not seen since April last year.

AI BTC price prediction. Source: Finbold

AI BTC price prediction. Source: FinboldHowever, the average figure might be somewhat deceptive. Namely, Claude Sonnet projected a potential 7.44% rally and a $82,500 price target. In contrast, Gemini and ChatGPT suggested Bitcoin could drop 5.58% to $72,500 or 2.32% to $75,000, respectively.

In other words, the three AI models remain sharply divided on Bitcoin’s near-term trajectory, reflecting elevated uncertainty in regard to macro policy, institutional positioning, and market liquidity.

All in all, they suggest “digital gold” is likely to remain range-bound into late February, but their individual discrepancies show that some erratic chart movement is also possible, as Claude Sonnet’s aggressively bullish stance balances out the more bearish sentiment displayed by Gemini and ChatGPT.

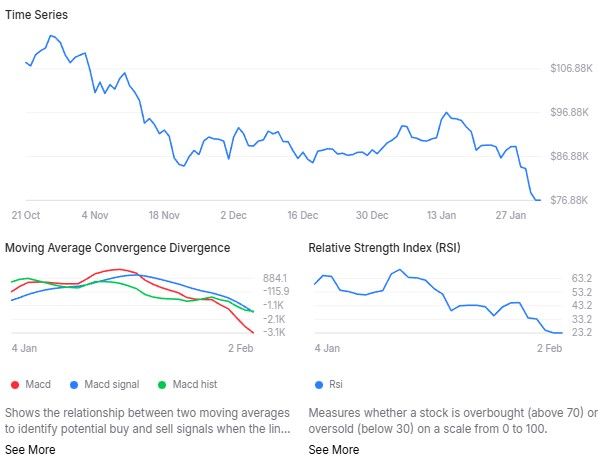

Finbold AI BTC technical analysis. Source: Finbold

Finbold AI BTC technical analysis. Source: FinboldFebruary 2026 Bitcoin price outlook

Overall, Bitcoin’s drop reflects a self-reinforcing combination of tighter macro expectations, institutional retreat via Bitcoin ETFs, and the unwinding of leveraged positions.

The asset has broken below key weekly support levels, including the critical 200-day Simple Moving Average (SMA) of $103,947, while the 14-day Relative Strength Index (RSI) reads 23.37, indicating deeply oversold conditions and weak momentum.

At the same time, the weekly MACD remains deeply negative and repeated failures near the 0.786 Fibonacci level ($102,700) formed lower highs.

Market participants are now watching whether BTC can reclaim the $78,000 level associated with recent liquidation dominance as a potential signal that selling pressure is easing.

Featured image via Shutterstock

The post AI predicts Bitcoin price for February 28, 2026 appeared first on Finbold.

6 hours ago

972

6 hours ago

972

English (US)

English (US)