Bitcoin, Ethereum, and other digital assets have witnessed a sharp retrace during the last 24 hours, which has resulted in a long squeeze on derivatives exchanges.

Crypto Long Liquidations Have Neared $600 Million During The Past Day

According to data from CoinGlass, the latest sharp price action in the cryptocurrency market has accompanied a huge amount of liquidations over at the derivatives side of the sector.

“Liquidation” here naturally refers to the forceful closure that any open contract has to undergo after it has amassed losses of a certain degree. For long investors, this happens when the asset’s price drops, while for shorts, liquidation occurs after a surge.

How much the cryptocurrency will have to move in one direction to liquidate a specific position comes down to the percentage threshold defined by the platform and the amount of leverage that the trader has opted for. During sharp price swings, positions with high amounts of leverage attached are the first to go.

Bitcoin and other assets have faced some notable volatility during the past day, which has once again caught out traders on the derivatives market. As the table below shows, liquidations have crossed $650 million over the last 24 hours.

About $584 million of these liquidations involved long positions alone. That’s equivalent to almost 90% of the total, showcasing how disproportionate the price volatility has been during this period.

In terms of the individual symbols, the largest contributor to the liquidation event has been Ethereum, not Bitcoin, as is often the case.

With over $235 million in contracts involved, Ethereum has notably outpaced Bitcoin, which has witnessed $186 million in liquidations. ETH facing more liquidations is likely due to the fact that its price drawdown has been stronger during the past day.

Out of the altcoins, Solana has come out on top with $37 million in positions flushed, ahead of XRP ($16 million) and Dogecoin ($12 million). Interestingly, SOL has outperformed the two despite its losses being more limited.

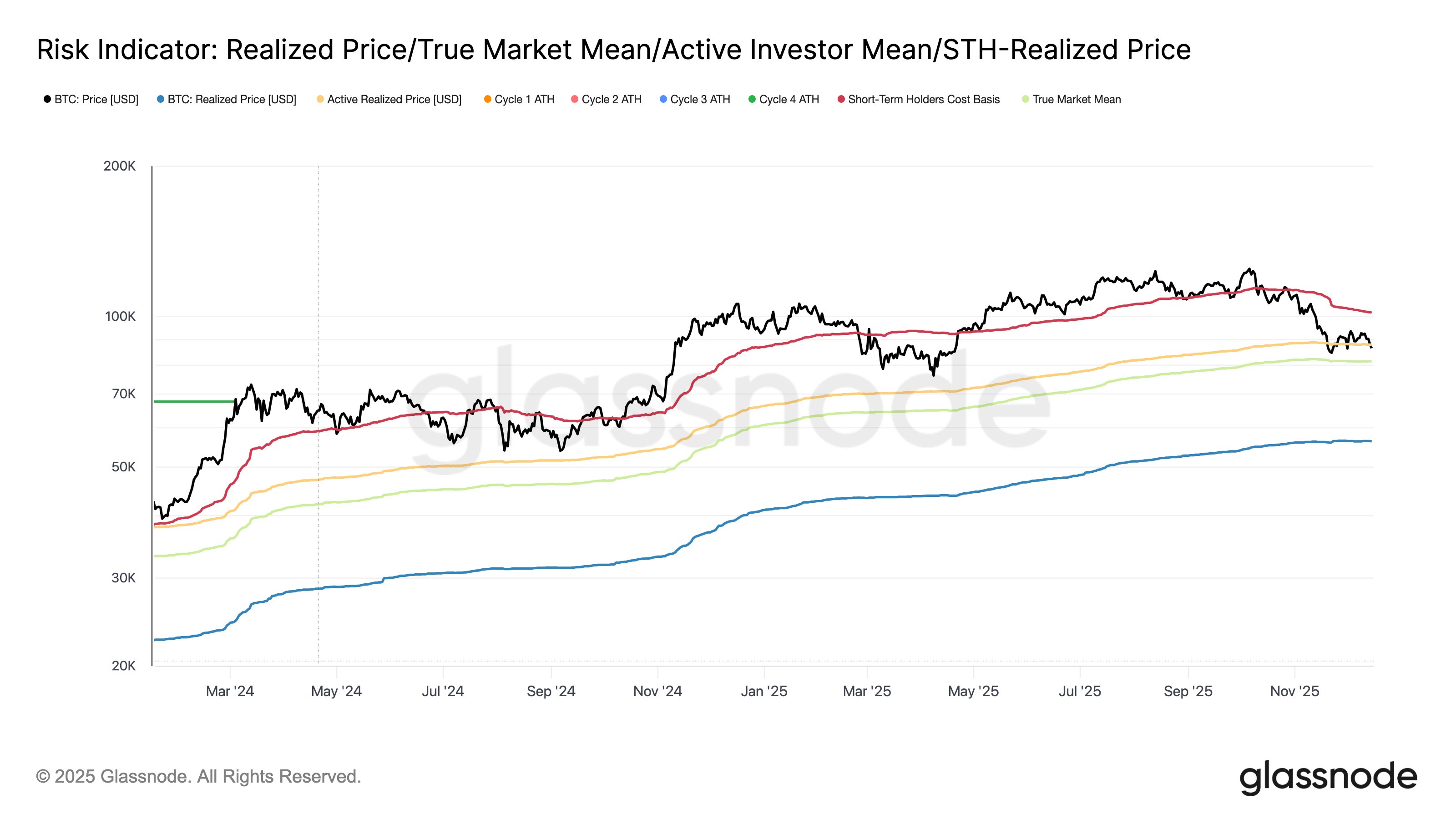

In some other news, the latest Bitcoin decline has meant that its price has fallen back under a key on-chain price level, as the chart shared by analytics firm Glassnode shows.

The level in question is the Active Realized Price, corresponding to the cost basis of the active participants on the Bitcoin network. Currently, it’s located at $87,900, which is above the cryptocurrency’s spot price.

Thus, it would appear that the latest dip has put the active investors as a whole into a state of net unrealized loss.

Bitcoin Price

At the time of writing, Bitcoin is floating around $87,200, down more than 3% over the last seven days.

1 month ago

5294

1 month ago

5294

English (US)

English (US)