In a week where the cryptocurrency market has suffered one of its more brutal losses, whales appear to be taking advantage by accumulating several assets.

In this context, on-chain data indicates that mysterious whales are actively scooping up Bitcoin (BTC) and Ethereum (ETH), signaling strong conviction in a potential recovery.

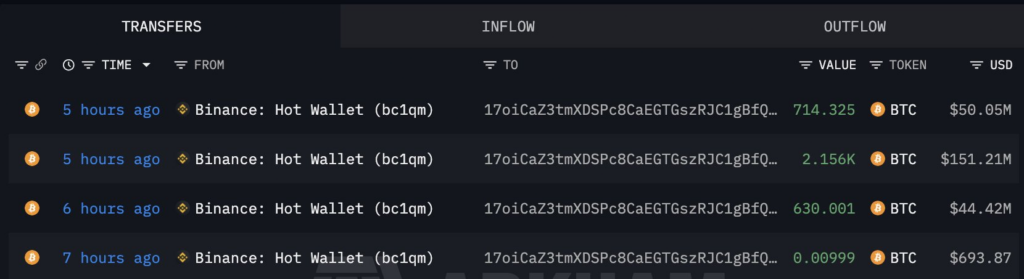

Details of the trades show that two newly created wallets executed massive withdrawals from Binance. The Bitcoin wallet, identified as 17oiCa, pulled in approximately 3,500 BTC valued at around $249 million through multiple transfers: 714.325 BTC worth $50.05 million, 2,156 BTC worth $151.21 million, 630.001 BTC worth $44.42 million, and a small 0.009999 BTC worth $693.87.

Simultaneously, the Ethereum wallet accumulated 30,000 ETH worth about $63 million, including 20,000 ETH valued at $42.02 million and 10,000 ETH worth $20.98 million, according to the latest on-chain data retrieved by Finbold from Lookonchain on February 8.

Bitcoin whale transaction. Source: Lookonchain

Bitcoin whale transaction. Source: LookonchainThese outflows align with a broader trend of whale accumulation observed in early February 2026. Reports indicate significant Bitcoin buying across holder cohorts following the sharp capitulation, with entities adding thousands of BTC in recent sessions as retail selling pressure eased.

Ethereum has seen even more aggressive moves, with whales withdrawing hundreds of thousands of ETH from exchanges such as Binance, Kraken, and others, pushing reserves to multi-year lows.

Large addresses have pivoted from prior distribution to heavy buying, including coordinated transfers to self-custody wallets during the dip.

Impact on prices

By withdrawing large volumes from exchanges, these holders reduce tradable supply, helping stabilize prices, limit downside risk, and create scarcity that supports rebounds. This has already aided Bitcoin’s quick bounce from its weekly low and could open the door to tests of $75,000 or higher if momentum and sentiment improve.

For Ethereum, falling exchange reserves reinforce its scarcity narrative, especially within DeFi, and could drive stronger upside if institutional interest or adoption narratives return.

While risks from thin liquidity, deleveraging, and macro pressures persist, such accumulation often marks cycle turning points, shifting assets from panicked sellers to long-term holders and rebuilding market confidence.

Bitcoin and Ethereum price analysis

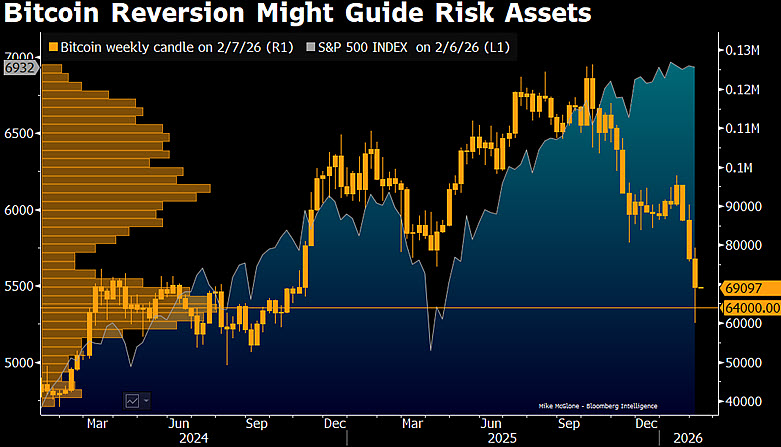

Indeed, this comes as Bitcoin has rebounded from lows near $60,000 earlier in the week, with prices reportedly reaching $71,000 in some sessions.

By press time, the maiden digital currency was valued at $70,886, having rallied over 2% in the last 24 hours, while on the weekly timeframe, the asset remains down more than 8%.

Bitcoin and Ethereum seven-day price chart. Source: Finbold

Bitcoin and Ethereum seven-day price chart. Source: FinboldOn the other hand, Ethereum has rebounded modestly, trading at $2,094, up 1.4% on the day. However, over the past seven days, ETH is still down nearly 10%.

Featured image via Shutterstock

The post Mysterious whales are accumulating these cryptocurrencies after market crash appeared first on Finbold.

3 hours ago

390

3 hours ago

390

English (US)

English (US)