The post ZIL Price Explodes Over 70% as Zilliqa’s Network Upgrade Sparks Momentum appeared first on Coinpedia Fintech News

ZIL price surged more than 70% today, marking one of its strongest single-day performances in months. The rally unfolded as traders reacted to confirmation of an upcoming Zilliqa network upgrade, triggering renewed attention toward the protocol at a time when the broader crypto market remains under pressure. While most large-cap and mid-cap tokens struggled for direction, Zilliqa price attracted concentrated inflows, pushing it decisively out of its recent consolidation range. As volume accelerated and volatility expanded, the focus quickly shifted from whether ZIL could move to how sustainable the move might be.

Zilliqa’s Upgrade Catalyst Drives Spot Demand and Narrative Shift

ZIL price rally followed confirmation of a significant Zilliqa network upgrade, which laid out concrete technical and ecosystem developments rather than vague roadmap promises. The network rolled out node version 0.20.0, aligning Zilliqa with Cancun-era EVM functionality and setting the stage for a hard fork scheduled for February 5, 2026. This upgrade improves smart-contract compatibility, enhances tooling for developers, and lowers friction for applications integrating with Ethereum-based environments. Beyond core infrastructure, the update also introduced a meaningful institutional signal.

A government-linked trust network from Liechtenstein is set to participate as a validator, strengthening decentralization and validator credibility. Additional improvements included expanded API capacity for enterprise users and resolution of validator stability issues that had previously constrained performance. For markets, this was not abstract development talk, it was actionable progress, and price reacted accordingly.

ZIL Price Shows Massive Breakout: Is $0.0100 Next?

Zilliqa price chart shows a falling wedge pattern breakout with strong surge in volume. With the start of this month, ZIL price rallied more than 90% and skyrocketed above the supply zone of $0.007000. ZIL’s price action indicates a clear shift in trend, with price surpassing the short-term moving averages and is eyeing to smash the 200 day EMA cluster of $0.007800. Once ZIL price strikes above the zone, further rally would take shape which could push Zilliqa price toward $0.01000 in the near term.

On the downside, the former channel resistance now acts as near-term support. A sustained move back below that level would signal loss of momentum and put the breakout at risk. Until then, the chart reflects trend transition rather than exhaustion.

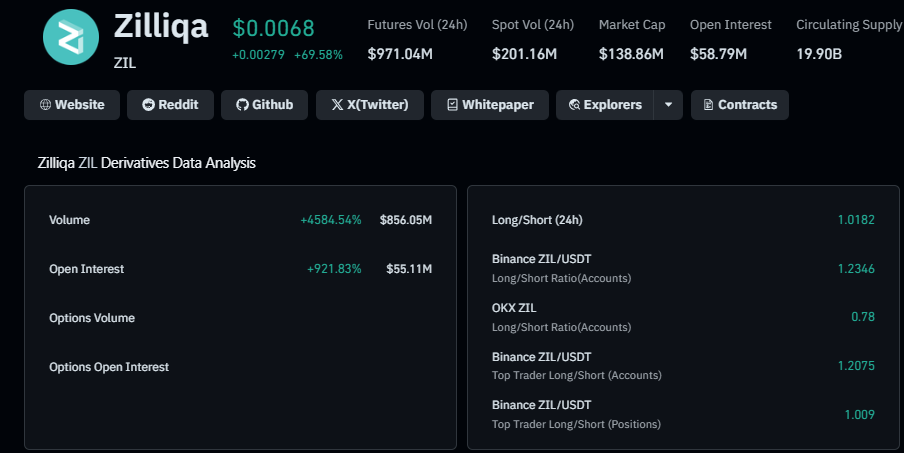

Derivatives Data Showed Forced Repositioning

ZIL’s rally was reinforced by a sharp and measurable shift in derivatives positioning. Total open interest surged to roughly $55.1 million, marking a near 922% jump intraday, a clear signal that fresh leverage entered the market rather than price moving on low participation. At the same time, 24-hour futures volume expanded to approximately $856 million, up more than 4585%, confirming that the breakout attracted broad-based speculative interest across major venues.

Long/short positioning tilted decisively toward the long side, with the aggregate long-short ratio pushing above 1.20, indicating bullish dominance but not yet an overcrowded long trade. Liquidation data further supports this structure: short-side liquidations dominated, while long liquidations remained relatively contained, suggesting bearish exposure was flushed as price accelerated. This combination of rising open interest alongside expanding volume typically reflects new directional conviction, not late-stage short covering alone, which gives a clear bullish outlook.

1 hour ago

211

1 hour ago

211

English (US)

English (US)